Today, the DeFi experiment has matured into something that most of us could not imagine only a few years ago. The Ethereum ecosystem paved the way, instantiating the very first instances of crypto-native financial protocols like capital markets, algorithmic stablecoins & AMMs.

With DeFi’s product-market fit in mind, the scalability challenges of Ethereum L1 naturally encouraged a substitution effect; when full cream milk is too expensive, you start to drink skim. Users migrated in droves to alternative L1 ecosystems of both the EVM and non-EVM flavor, taking their precious TVL along with them. Ecosystems like Moonbeam, Algorand, Terra, Polkadot, Near, Avalanche, Solana, Fantom, Polygon, Cosmos & BNB boast 10’s of developer teams building and deploying DeFi protocols with billions in value locked.

The unfortunate consequence of this fragmentation is the breakdown of capital efficiency. Capital has become siloed in individual ecosystems each vying to keep the capital-deployers on their chain. Users today need to interact with different base layer protocols, each with their own wallets, their own tooling, and fundamentally, their own DeFi protocols which demand their own share of the scarce pie of capital.

When thinking about the current landscape, does it make any sense that the future of on-chain DeFi is restricted to any one chain? Does anyone connected to the web really know if their data is being sent via TCP or UDP? Does anyone really care? We believe the answer is no. Users should not (and likely will not) care which protocol they are using.

And why should they? Each L1 is unique in its own way. Terra offers native stablecoins, Moonbeam offers developer-friendly Polkadot access, Algorand offers decentralized scalability, Solana offers a composable, monolithic platform. They use each protocol as the need arises.

At the same time, cross-chain bridging infrastructure is being developed at an incredibly rapid pace. Technologies like Wormhole, IBC, XCM, LayerZero, State Proofs, Synapse & Axelar are deployed or deploying, offering users trustless (or close-to-trustless) interchain token transfers & message communication.

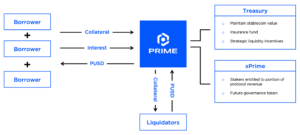

This is why we are excited about Prime Protocol. Prime is an abstraction layer. At its core, it maps local DeFi into global DeFi. Prime enables users to have collateral across different L1’s, and cross-margin their capital on a net portfolio basis without wrapped tokens or bridged assets. You can have your cake and eat it too. Prime allows you to borrow against your entire portfolio of L1 assets, like AVAX, ETH, BNB or MATIC, without ever leaving the chain.

At its core, Prime is one of the first applications building on the top of the crypto equivalent of the OSI stack.

We believe this is the next generation of DeFi xApps, and we are incredibly proud to back Colton Conley – a young and ambitious founder – and the rest of his team in bringing this vision to life. It has been an absolute pleasure to work so closely with him, and look forward to the next chapter of global DeFi.

Medium: Introducing Prime Protocol

Axios: Many blockchains, one credit line: Investors back new DeFi protocol

Twitter: Thread